Yesterday I made the mistake of trying to drink a cup of coffee and read my new 2022 home value at the same time.

After I finished choking and wiping the coffee off of my computer monitor, I started browsing social media to see if others were in the same boat as me. As expected there was a wide range of opinions, from one group being happy about the new higher value to others believing that council members were personally manipulating the entire North Texas real estate market to pay for cardboard recycling.

As I looked back through the history of my home value, I can say that it has consistently tracked with inflation since it was built in the late 70’s. It has doubled in value about every 20 years, which is reasonably healthy. From 2016-2022, it doubled in value again.

From a property tax perspective, that’s insane. One of the larger bills I have every year is my tax bill. Last year, I paid $5,860 in property taxes, and if rates remain unchanged, the 2023 estimate is $6,500, (and only because the Texas constitution caps it from going any higher). If this trajectory holds, I’m anticipating 10% growth in my taxes for four more years just to catch up to this year’s property value. That puts my 2026 tax bill at $9,516.65, or ~$800 a month. That’s higher than the principal part of my mortgage.

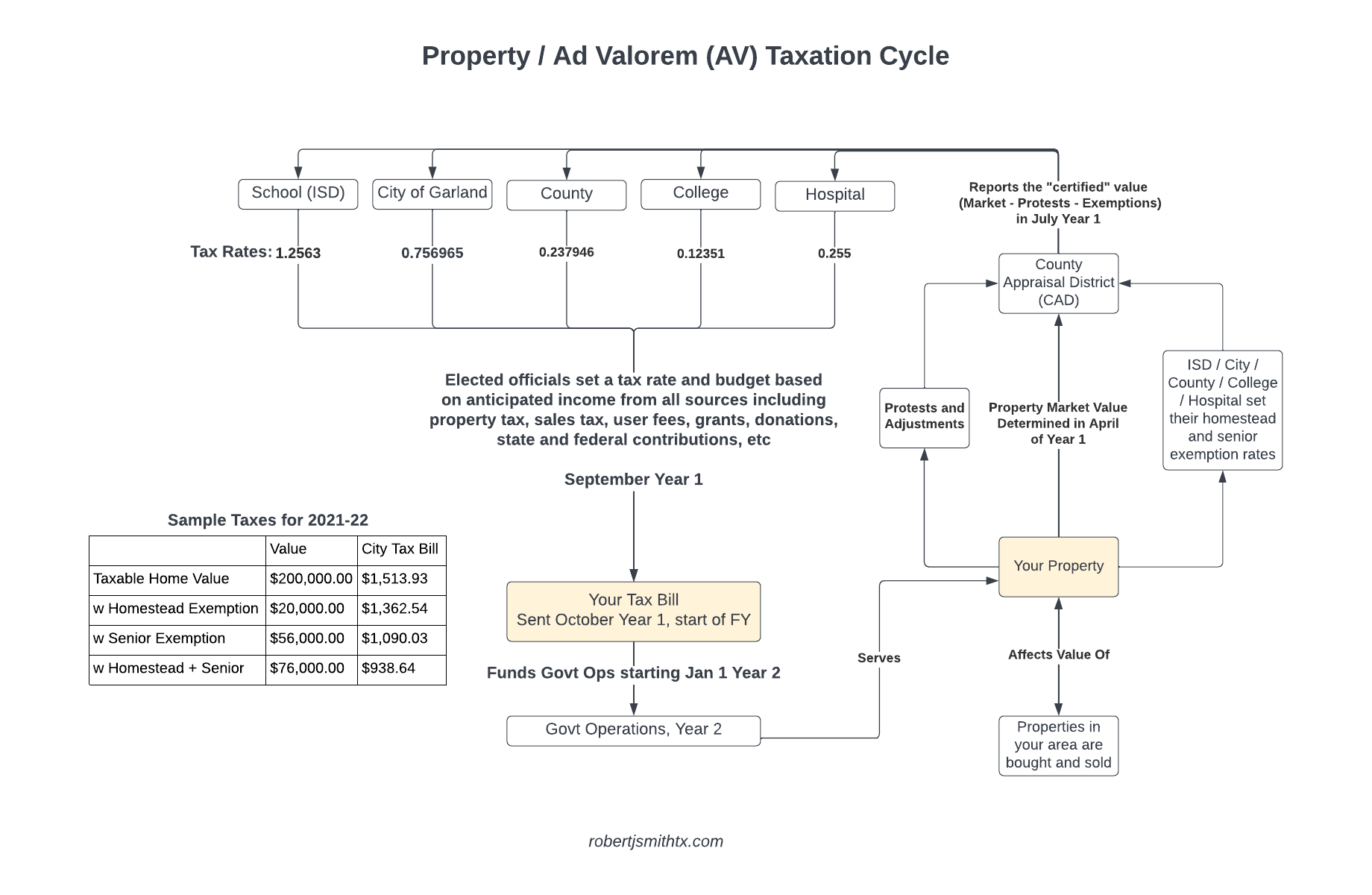

So who can fix this? Well, the City Council can help. We control the City tax rate. For anyone that wants to understand how the cycle of property value and tax rates works, here’s a diagram:

On council, I have a few major challenges that I’m trying to figure out how to work through this year. Here’s a list of problems and where I’m at on each of them. I want to stress as always that these are my personal opinions, they do not represent the entire council, and we haven’t voted on any of it yet. This is just a way for you to be able to get inside of my head, figure out what is driving my decision-making, and have an opportunity to steer me in another direction if you see something I’m either missing or thinking about incorrectly.

-

-

Inflation: Inflation ran about 8% last year. We have to figure out how to keep police and fire (among other city employees) generally paid a market wage. We must balance this with citizens’ right to not pay exorbitant taxes. Much like the 2014 recession recovery, we know that the public sector shouldn’t move faster than the market when it comes to cost of living adjustments (COLA) otherwise we become part of the inflationary problem. It’s a tough problem to crack and the timing is exceedingly difficult to get right.

In my other life in the private sector, I’m keeping employee salaries up with inflation (8%) + merit (1-5%) so that I can keep my employees ahead of the curve. But that’s very different because it’s my money; paying public employees is done with your money. I try my best to keep that in mind.

-

-

-

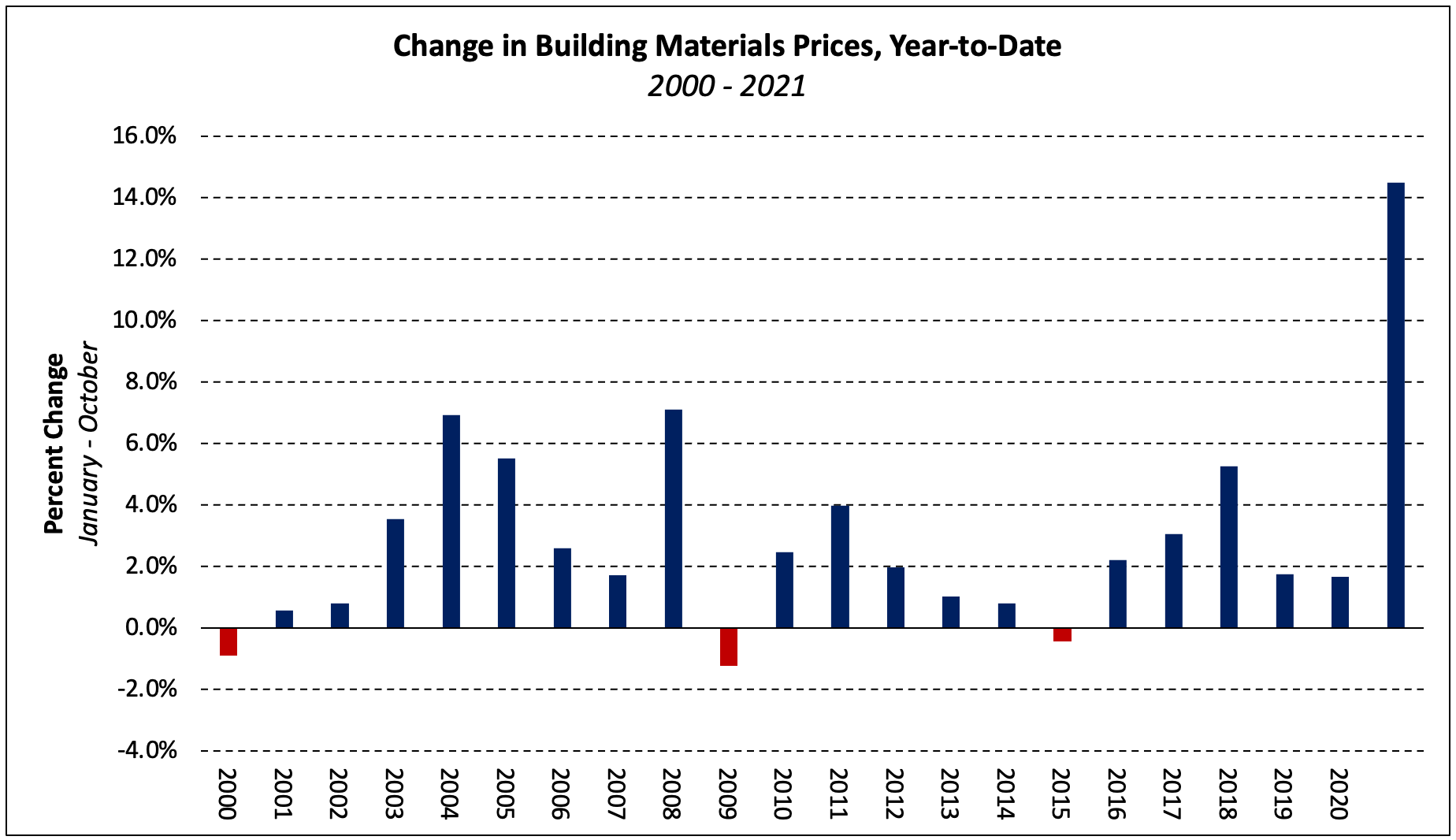

Bond Program: If you’ll recall, Garland voters approved a $423 million, 7-year bond package back in May of 2019. Almost every bond-funded project is running 25%+ over in materials cost. You all have probably seen what’s happened with lumber, steel, and wood prices over the past three years.

(source: https://eyeonhousing.org)In 2019, we built a 23% price hike into every project to offset inflation over those 7 years, which we thought at the time was a bit of overkill. The economy blew through that in year 2.

We’ve gotten creative and value-engineered a few things, looked for ways to alternatively source building materials, played with timelines and found ways to reduce costs in fixtures and furniture. But with land at all-time highs and commodity prices up 50%, something is going to have to give.

Council is meeting later next month to figure out a path forward. I’m looking at cutting my own proposed projects, lengthening the bond program to 8 or 9 years to stretch out our expenses, reducing project scopes, and working harder on finding additional grants and federal funding. We’ve also looked at bulk purchasing of building materials that span multiple projects to take advantage of economies of scale, but that has been somewhat harder to do in this market.

We’ve also run into our usual share of unexpected things, like finding shortcuts taken in old buildings 50 years ago that we have to correct, underground springs that we didn’t know existed, etc. We had built in a bit of wiggle room for these unforeseeable expenses, but that budget has quickly evaporated due to the inflation.

One option for us is to look at sacrificing operating cash for additional debt capacity to pay for these projects. As a person that really doesn’t like debt to begin with, I don’t want to see us go down that path. It starts a cycle of deferring maintenance that is usually cash-funded and just snowballs us into a debt-first mindset. Debt costs us even more in the long run than if we’d just fixed broken things in a timely manner. I’ll look at the numbers and give it fair-minded consideration, but it would be a very tough thing for me to vote for. I think we come out ahead doing a bit less and waiting for prices to stabilize.

We have a workshop / retreat scheduled for May 21, 2022 in order to work through these issues and lay out a clear path for staff prior to our adoption of the 2023 tax rate. It is a public meeting, and the details will be posted on the city’s website.

-

-

Exemptions: In prior years, we’ve looked at providing tax relief through increasing the Homestead and Senior exemptions. I don’t think that’s the way we need to go this year. Essentially, we have three buckets to work with when it comes to taxpayers in the city. We have seniors, homeowners, and businesses (which includes retail, industrial, commercial, landlords, multifamily, etc).

Because we are all getting equally hammered by supply chain and labor costs, I think it’s appropriate to pursue tax relief for the entire city as opposed to any one of the subgroups. As I look at the numbers today, I want us to lower the overall city tax rate instead of increasing exemptions. I chair the Administrative Services Committee, which reviews the exemptions each year and forwards a recommendation to the council. Our committee is sending a recommendation of ‘no change’, which, if adopted by the council, will set the stage for treating the coming tax rate discussion as it applies to everyone.

Conclusions:

So that’s where we are folks. High inflation mixed with an insanely hot property market is making it really tough to keep taxes reasonable, while maintaining city service levels, and making progress on the bond. We’ll adjust to the market, re-evaluate all of our goals, and try to do it all while delivering more value to you as a taxpayer in a way that doesn’t break the bank. We’ll trim the fat in government that naturally develops over time to make sure we’re making the best use of each dollar, and we’ll ask the hard questions about size and scope of governance. We’ll do it all within the terms laid out by the state constitution and ‘SB2’ which is the latest adjustment to property tax rules from the state legislature.

Suggestions, comments, criticisms, *creative* name-calling, and prayers are all welcomed and appreciated.

-RJS

Important Dates:

| Appraisal Protest Deadline | May 15th, 2022 |

| Council Retreat | May 21st, 2022 |

| City Receives Certified Property Values | July, 2022 |

| Council Considers ’23 Budget and Tax Rate | August – September, 2022 |

| Taxes Due | October 1, 2022 |

| Taxes Delinquent | January 31, 2023 |

Useful Links:

Appraisal District: https://www.dallascad.org/

Appraisal Protest Process: https://www.dallascad.org/Forms/Protest_Process.pdf

2019 Bond Program: https://www.buildgarland.com/home