Another two years have gone by, and candidates are once again addressing the concept of abolishing the property tax. Increased local spending, skyrocketing property values, and an increased tax burden continue to haunt homeowners’ checkbooks. Legislators are looking for ways to reduce that financial burden.

Assuming that our local governments would actually be able to function and provide basic services under that plan (and that’s a “yuuuuge” assumption), let’s look at the underlying philosophy and see if it holds up.

Supporters of abolishing the property tax say that it will help people stay in their homes as income lags behind home value and tax amount increases. Opponents are worried about funding basic services, and question the formulas and other motivations that have been put forward by the proposal’s biggest supporters.

There is a strong instinct to vote for the things that we believe will be in our best interest, but I’d like to make the case that ‘some’ property tax just might be a good thing. Conservatives- don’t close your browser in anger and start muttering about rinos. Just bear with me for a few minutes.

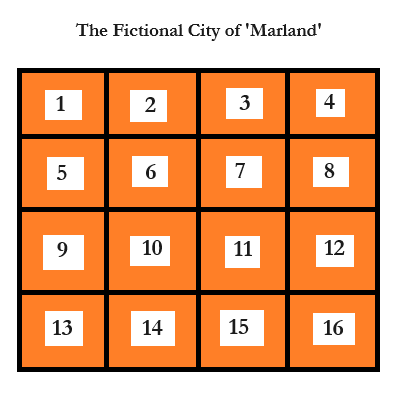

Let’s imagine the fictional city of ‘Marland’ (it’s only a model). To keep it simple, we’ll illustrate it with 16 distinct property tracts.

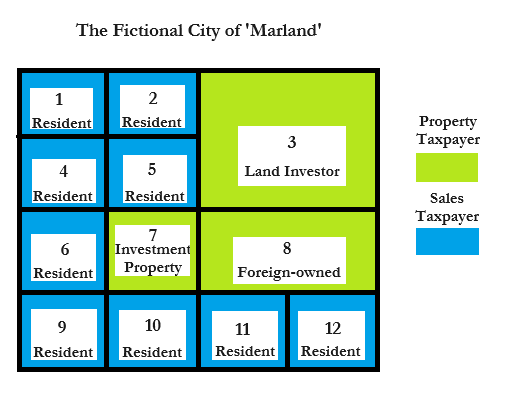

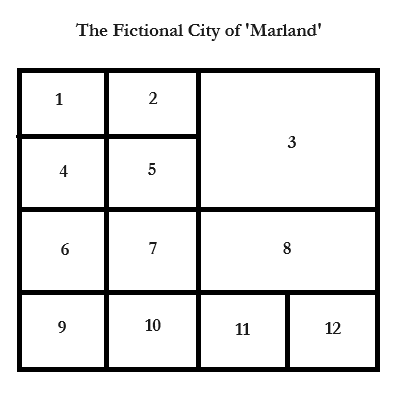

This city has fire, police, roads, and libraries. Now, let’s say that we eliminate the property tax as proposed. The only people paying into the system for those city services are those that buy goods and services within the city limits. Let’s look at the city model again, but now with a few owners assigned. I’ve given each individual a number.

In this example, owner number 3 owns four parcels of land, and owner number 8 owns two.

Owner 3 purchased a few parcels of land and established their house in the middle of it. With no property tax they now claim four times the amount of city service, with no additional cost. Owner 8 did something similar with two parcels of land.

This isn’t a deal-breaker, because sales tax is still in play. It’s possible that owners 8 and 3 spend quite a bit more money within the city borders, and maybe even more than their share. The next example is where it falls apart.

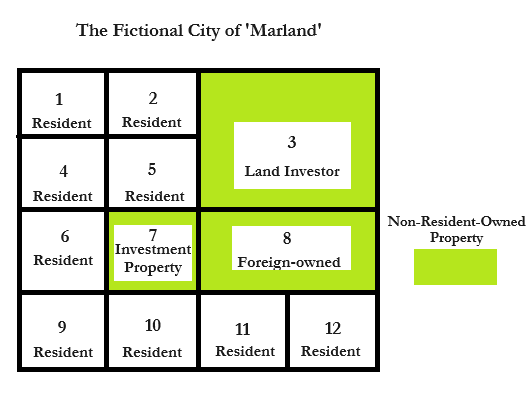

Owner 3 is an outside investor from another state that now owns a quarter of the land and pays $0 into the state or the city coffers in any meaningful way. Owner number 8 in this example is a Canadian firm (or North Korean for that matter) that also pays $0. Owner 7 is an in-state investor earning income from that property.

With this example, almost 1/2 of the town pays $0 in sales or property tax and is still entitled to city services that are paid for by the other residents.

Obviously, this is a bad idea. It puts the burden of supplying city services for corporations and investors onto the residents that were supposed to get the majority of the relief. This just doesn’t work.

But not all hope is lost. There is a hybrid solution here that could work, assuming the legislature can provide enough funding to localities to cover basic city services- again, a big assumption. It ensures that residents and non-residents all have a vested interest in a community, all while keeping people in their homes.

Over time, move the homestead exemption rate toward 90-100%.

This ensures that the people are not being taxed out of their homes. It does not create a massive corporate welfare scheme to take the risk out of land speculation. It doesn’t reward out of state of foreign ownership. It takes a financial risk out of personal home ownership and does not reward bad business decisions. It allows for the state’s conservative legislators to make good on their promise of keeping people in their homes, while using the formulas that they have devised to help keep basic city services in play and keep the lights on.

While there are a number of well-meaning people that want to eliminate the property tax fully in order to keep seniors from being taxed out of their homes, the real money behind this push comes from people that want to speculate and develop land without financial risk. Business is not entitled to zero risk at taxpayer expense, and full removal of the property tax would be one of the biggest corporate welfare schemes since TARP. The wealthy can amass an enormous amount of land with zero risk and zero cost for their entire life, handing down the land for generations that essentially prints money and creates an aristocracy. Europe experimented with this system for many years where it was called Feudalism. It didn’t work there, and it doesn’t need to be tried here.